This is a basic list of typical expenses incurred by artists. Completing your tax return.

Is Your Tattoo Shop Ready For Tax Day Daysmart Body Art Inkbook Tattoo Software

Most Tattoo Artists are known for their individual creativity out-of-the-box thinking and non-conformist mentality all in a very positive wayTattoo Artists as independent contractors receive a Form 1099 for services and must report income.

. Most tattoo artists are self-employed which leaves them solely in control of their taxes. What better way to. Im a tattoo artist working for a shop.

Its lightweight GM-less and can be played without any prep or study. In different parts of the country and in different states tattoo shops are run in different ways. If a studio owner rents booths to his artists the cost of the rental can be.

While many of your clients may come from word-of-mouth marketing tools are an often overlooked deductible expense. Enter the amount you can deduct on the Artists employment expenses line 9973 of Form T777 Statement of Employment Expenses. Recording expenses accurately can significantly reduce the amount of tax you end up paying each year.

Use this list to help organize your art tax preparation. Whether self-employed or part of a business understanding how to file your taxes correctly is vital to your cash flow. For self employed tattooist tattoo artist tattoo studios tattoo shops in New York USATattoo Artist accounting software for less than the price of a tattoo.

This calculates your Social Security tax and Medicare tax on your profit. When Tattoo Shop Owners improperly classify their Tattoo Artists as independent contractors the Internal Revenue Services loses out on revenue and therefore Tattoo Shop Owners may. If I need to edit or am breaking rules which I did read but my situation is unique.

Its also a competitive party game of deduction gambling and competitive doodling. File With Confidence Today. TATTOO is a roleplaying game about tattoo artists their clients and the reality TV show that puts them in the spotlight.

Composed a musical dramatic or literary work. Please bear with me as I attempt to explain my strange situation in its entirety. Tattoo supplies of 100 per month are anticipated to replenish items purchased before the launch.

Use Schedule C if your expenses are greater than 5000. Youre able to claim this deduction if youre in a recognized artistic field as defined in the Income Tax Act. You may have others.

Answer Simple Questions About Your Life And We Do The Rest. Art Gallery and Tattoo Studio Offering Custom Tattoos Paintings Clothing Accessories More. I have tried to use the search function but cant seem to find a story like mine.

You may have to be lisenced as a professional to claim deductions as a professional tattoo artist. Mar 28 2017 Multiple scenarios can play out in terms of the tax deductions available to a tattoo artist each one tied to the nature of the artists business relationship with a studio. First theres a special deduction for expenses paid in 2018 to earn employment income from an artistic activity.

Tattoo Artists as independent contractors receive a Form 1099 for services and must report income on Schedule C and pay self-employment tax on the net profit. If a studio owner rents booths to his artists the cost of the rental can be deducted as a business expense as can the cost of supplies like ink and needles. No Tax Knowledge Needed.

Enter the amount from the Total expenses line 9368 on line 22900 of your return. A qualified trade or business is any trade or business with two exceptions. Now lets back up a little bit because if youre in the US.

And its a hack of Taboo the classic guessing game. 1126 1st St S. Payroll taxes of 15 and employee benefits of 10 health insurance are applied to payroll for the Hunts and the second artists wages.

You pay this with your income taxes but you also get a deduction of half this amount before you calculate the income tax. Yes the IRS likes consistency so it is always a good thing to report business income and expenses the same way year after year on your tax returns. Any of the following must apply to you.

My husband is a tattoo artist and makes 60 off each tattoo and the shop takes 40 of that can we deduct the 40. Ordinary Tax Deductions 723 The first umbrella of tax deductions are called ordinary deductionsThese are deductions that are typical to all businesses. Spread Love With Art Gallery Tattoo.

Self Employment Taxes for tattoo artists and a huge mess. Doug just like any other profession it is important that you file taxes keep reciepts of your supplies and equipment for deductions. Simplify your tattoo studio bookkeeping and 2016 year end accounts preparation.

An artist may also deduct the cost of museum and gallery memberships traveling to tattoo shows whether you work there or not and even trade magazine subscriptions as business-related expenses. Art supplies Books magazines reference material Business gifts Business insurance Business meals Cabs subways buses Copying printing Cultural events museum entrance fees Entry fees Equipment and software Film. Itll turn out to be Schedule C profit 09235 0153.

Do I give the shop a 1099 or do they give me one. New York Non-Sales Tax Tattoo Artist Bookkeeping Spreadsheets for 2016 year end. Specified service trade or business SSTB which includes a trade or business involving the performance of services in the fields of health law accounting actuarial science performing arts consulting athletics financial services investing and investment.

I pay the shop 50 of what I make. Winter Haven FL 33880. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

Multiple scenarios can play out in terms of the tax deductions available to a tattoo artist each one tied to the nature of the artists business relationship with a studio. You pay taxes to the IRS and theres a way that the IRS describes what a business expense or tax deduction is. Inflationary increases are applied to most items and to prices charged to customers.

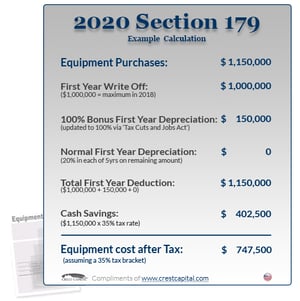

Deduct Your Tattoo Removal Laser All About Section 179

Tattoo Artist Tax In The Uk Explained Barber Dts

How To File Taxes As A Tattoo Artist How To Discuss

3 Types Of Tax Deductions And How To Track Them

How Much To Tip A Tattoo Artist Trending Tattoo

Tattoo Artist Tax In The Uk Explained Barber Dts

0 comments

Post a Comment